In its latest forecasts on IT spending trends, Gartner refers to 2018 as the year of digital storm – and it goes on to ask business organizations:

Will you Sink or Surf?

Gartner’s predictions hold two key findings: you could either reach unprecedented new heights by taking advantage of the digital storm or succumb to the overwhelming nature of the rapidly shifting digital tides that influence internal business operations and drive external market competition. The predictions point to the emergence of new business models and new pathways to embrace IT as a business enabler. Organizations that are ready to exploit the rapid change will dominate the competition and must therefore prepare for the digital disruption now.

Cloud Will Drive the Digital Disruption

2018 has been a unique year for IT spending trends. Gartner predicts that global IT spending will reach $3.7 trillion by the end of the year at a staggering 6.2 percent increase from 2017. Gartner’s assessment of 1748 markets also found that IT spending in the year 2018 will see higher growth than the CAGR for the period 2017-2022.

In terms of U.S. dollars, this is Gartner’s highest percentage growth forecast since 2007. The constant-currency growth forecast was maintained from last year at a strong 3.0 percent despite the currency tailwinds against the U.S. Dollar. Global companies can expect extra funds coming their way due to the favoring currency exchange rates as they grow their business through increased IT spending.

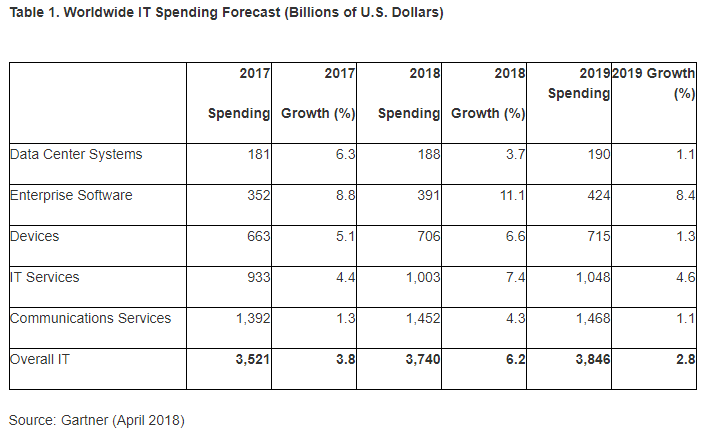

The chart below shows detailed forecast statistics across the leading areas of technology investments:

Analyzing Gartner’s Forecast:

The numbers portray a revealing image of the current and future IT spending trends, but a detailed assessment of the background drivers of digital disruption across these market segments is required to understand the changes and future outlook:

1. Proliferation of High End Smartphones: Growing Market for Next-Gen Consumer Apps and IT Services

The device spending forecasts highlight an interesting trend with the high projected growth rate of 6.6 percent as compared with 5.1 percent from 2017. A separate analysis by the research firm IDC found that Q1 2018 saw 2.9 percent fewer device unit shipments globally. The apparently contradictory findings suggest that while fewer customers bought new devices, their purchases have been inclined toward high-end smartphones. The Apple iPhone X is a prime example that maintained high customer investments despite the low sales figures, which reportedly forced the company to reduce production target by 50 percent. Strong adoption of high-end smartphone technologies suggests that consumers are growing comfortable with next-generation mobile technologies such as AI voice assistance, high-quality video streaming and gesture controls, among others. These technology avenues open up new markets and revenue opportunities for organizations competing in this segment.

2. Cloud Will Drive the Digital Disruption

The highest growth forecast was observed for the enterprise software market at 11.1 percent. The trend points to a big picture story: software really is eating the world and is dramatically reducing IT infrastructure cost investments as businesses increasingly invest in cloud-based solutions as an affordable OpEx instead of deploying investment-intensive high CapEx IT infrastructure solutions on-premise. The shifting focus is evident considering the forecast for datacenters market that is expected to have the lowest growth rate of 0.5 percent. Essentially, the money is flowing out of the datacenter business and into the cloud services market. Business organization considering IT investments in cloud versus datacenter solutions should therefore evaluate the reasons behind the shifting market trends and understand the resulting value propositions to their organization. For small to midsize businesses, cloud offers the agility to leverage the IT service and realize business value at speed. On the other hand, datacenter investments will continue to favor large enterprises seeking long-term savings in Total Cost of Ownership, strong control, security and performance policies, as well as the available expertise and resources to deploy, manage and maintain the IT infrastructure. In fact, the market segments of PCs, servers and IT maintenance businesses will shrink in 2018 as the project hardware sales continue to decline.

3. Telecommunication R&D Will Drive Down Costs and Boost Performance

The communication services segment is undergoing consistently low percentage increase in IT spending budget although communications serve as the backbone of all technologies ranging from consumer mobility to enterprise cloud software solutions. This trend is justified by the improvements in R&D efforts toward next-generation communication technologies that reduce the cost of service while improving network performance. The launch of 5G technologies will further reduce the cost of telecommunication services. Fast Internet services will be available to a growing consumer market at lower cost. Enterprise IT organizations will develop more functional, powerful and high-performance software solutions delivered across cloud networks as a service at low latency, high bandwidth capacity and faster data transmission speed.

Digital Disruption for Startups and Large Enterprises

Although the growth of overall IT spending will remain consistent in coming years, organizations should analyze the turbulence at the market segment level to understand the shift in industry trends. Organizations need to understand how granular changes in the industry impact their business and how they should react to the disruptive forces in the industry. Startups must understand how specific IT market segments will catalyze innovation and position their organizations as future leaders in industries previously dominated by large enterprises focused on IT technologies that no longer have the potential to disrupt the future.

Similarly, large enterprises need to evolve their business and adopt digital disruption as a strategic necessity. This involves rapid adoption of digital technologies to transform the way they operate internally and how they approach their markets. As a result, enterprises can use their vast resources to gain the flexibility to transform business models and products for future acceptance in the industry and perhaps even create new markets. For example, organizations architecting solutions with APIs, containers and microservices can expect a low threshold for adoption in the industry as the heterogeneous application stack can be ported in different environments as needed.

While Gartner’s forecasts present a revealing image of future IT purchase trends, organizations must consider the wider IT spending portfolio to devise strategic decisions associated with IT investments. For instance, Gartner’s numbers don’t include the labor and HR costs associated with employing, managing and maintaining new technologies.

In essence, 2018 IT spending will be all about capitalizing the value of the digital storm to gain competitive advantage against industry laggards that still focus on traditional IT strategies, technologies and markets.